November 29th, 2018.

Stadium Property Prices: These Are the New Football Stadiums Currently Being Built

If you read part one of our stadium study, you’ll know that investing near a football stadium in the UK has paid-off considerably for investors over the last few decades. In some cases, reaching property price increases of more than 650%!

But, does that mean putting your money into property near stadiums is a good investment today? That’s exactly what our experts will discuss here.

New UK Football Stadiums in the UK – Will House Prices Rise?

Brand new stadiums currently being built or recently completed:

• Tottenham

• Plymouth Argyle

• Brentford

• Aberdeen

• Stevenage

• Accrington Stanley

Stadiums currently being redeveloped:

• Turf Moor

• Fulham

• Oldham Athletic

• Anfield

New White Hart Lane

(image: Tottenham Hotspur)

Tottenham Hotspur’s stadium in North London is currently under construction and Spurs will hopefully move into their new home in early 2019, replacing their previous home, White Hart Lane. With a planned capacity of more than 62,000, it will become one of the largest in the Premier League and the biggest club stadium in the capital.

First conceived in 2007, the new stadium’s builders broke ground in 2015 and it is intended to be the catalyst for a 20-year regeneration project in Tottenham.

This has certainly begun, even before the stadium is complete. There has been over £100m invested in transport infrastructure with the nearest station, White Hart Lane, currently being improved with plans for a Wembley-style walkway for fans to safely get from the station to the stadium.

To make way for this, a council housing tower block and rows of shops were demolished.

According to Halifax and Land Registry data, the average home value in the postal district surrounding Spurs’ stadium rose more than seven and a half times in the two decades between 1997 and 2017 from £59,638 to £450,104. Zoopla states the current average price around White Hart Lane is just under £460,000.

In 2017, when compared to property near any of the 49 football clubs that had played in the Premier League since 1992, homes near White Hart Lane had seen the highest value increase over the past 20 years.

New Griffin Park, Brentford

(image: Brentford FC)

(image: Brentford FC)

Originally planned to open its doors this year, Brentford’s new stadium in West London is now deemed to open ahead of the 2020/21 season.

“…at the heart of plans to regenerate the local area”

The stadium is being built by Buckingham Group and EcoWorld London less than five minutes from Kew Bridge Station and less than a mile away from Griffin Park. Alongside the stadium, 910 brand new homes will also be built. 572 of these properties will be delivered by Prime Place at the Lionel Road South site, with 338 units created by private rental company Be:here for use with institutional investment.

Like Tottenham, Brentford will have a new covered, but open-sided, link to the stadium concourse and an existing underpass from Kew Bridge Station beneath Lionel Road South will be reopened. Alongside this will be a public square, as well as shops and cafes.

Once opened, Willmott Dixon, owners of Be:here, will redevelop the old Griffin Park stadium site. Planning permission has already been consented to develop a further 75 two, three, four and five-bedroom family houses for private sale here, alongside a memorial garden to celebrate the history of the club.

So, what are property prices like? Well, Zoopla reports the current average value of a property near the stadium is more than £520,000 – 35% higher than five years ago, before the builders broke ground, and 253% higher than two decades ago.

Other UK Stadiums Due for a Change

• Millwall

• Luton Town

• Everton

• Crystal Palace

New Selhurst Park

(image: Crystal Palace)

(image: Crystal Palace)

In April 2018, Croydon Council granted permission for the redevelopment of Crystal Palace’s Selhurst Park. Expected to cost £75m to £100m, the project will include building of a new main stand with an all-glass front which will take the stadium’s capacity from 26,000 to 34,000, as well as provision of a number of new facilities for the community.

Crystal Palace Chairman Steve Parish said:

“I am absolutely delighted that Croydon Council has backed our plans for Selhurst Park. This project will not only transform the stadium, which has been our home since 1924, but it will also have a positive impact on the south London community.

“I want to thank everyone who voiced support and those connected to the club who worked so hard over the last few months towards this very important step in the dream of a new crystal palace for Crystal Palace”.

The plans are said to generate more than £15m a year for the local economy once the stand opens for the 2021/22 season, and discussions continue regarding the club’s Section 106 obligations to fund transport and community improvement initiatives.

According to Halifax and Land Registry data, house prices near the Crystal Palace stadium increased 510% between 1997 and 2017, from £53,651 to £327,074. The question now is: could the redevelopment further boost property prices nearby?

Everton FC’s Bramley Moore Stadium

(image: Everton New Stadium)

Everton has revealed plans to build a new stadium at Bramley Moore Dock in Vauxhall, Liverpool. The project is made possible thanks to a funding deal with Liverpool Council, with Dan Meis the architect. Although few details have yet been released, it seems the club are keen to not only develop the club but the wider region.

The stadium’s Development Director, Colin Chong, has released a statement online which says:

‘The opportunity we have to develop a stadium at Bramley-Moore Dock offers Everton a platform for growth and success. But it isn’t just a great opportunity for the Club. A new, iconic stadium will benefit the entire city region. The development at Bramley-Moore Dock, alongside the legacy project at Goodison Park, will act as a catalyst to regenerate the whole of north Liverpool. It will deliver a £1bn boost to the local economy, create around 15,000 jobs and increase tourism visitor numbers to Liverpool. The knock-on effect of a stadium at Bramley-Moore Dock will also kick-start the Liverpool Waters waterfront development and extend into the Ten Streets creative development.

‘The transformation to the city will be on a remarkable scale – and that transformation will be beamed across the globe every time we play a home match. I’m sure there will be no better backdrop to a stadium in the country. From a marketing perspective alone, the increased media focus afforded to both the Club and the city cannot be underestimated.’

Although early days, these plans could highlight an opportunity for investors and developers to get in ahead of the curve and make some real money once the development is underway, and complete. The current average property price in the areas surrounding the proposed stadium site is around £185,000. This has increased 25% in five years, and 217% over the last two decades. Could now be the time to invest in order to see a good ROI?

Millwall FC’s ‘New Den’ Stadium

(image: Millwall FC)

(image: Millwall FC)

If you want to get in at ground level, then keep an ear to the ground about developments coming out of Millwall FC.

Their current stadium, The New Den, can be found just a few miles from London’s financial centre and opened in 1993 after a £16million development. In September 2016, Lewisham Council controversially approved a compulsory purchase order (CPO) of land surrounding The Den which was rented by Millwall.

The club submitted its own regeneration plans but were turned down. After this, rumours swirled about further redevelopment plans, or possibly even moving the club to a new location. However, controversy then hit. The CPO was paused among allegations about Council leaders who approved the scheme.

In August 2018, it was reported that the club had appointed architects to draw up plans for its community programme, claiming they would never reach the Premier League without the space. The club told the BBC:

“We’re drawing up plans to see what this would be with the Premier League requirements and how this would cope.

“We’re showing that to the council and working to a pre-planning application so that we can clearly define what we need as a club.

“If the council know that and can see that and work with us so that we can deliver that, then we have a long-term future here.”

The average property price in nearby postcodes is around £505,000 – up more than 33% in the last five years, and 292% in the last two decades – and, if the club does stay put and is redeveloped, this could see local property prices positively affected.

Should You Invest in Property or Land Near a Stadium?

Looking at these figures, investing in property near a stadium could pay off. Although there are no guarantees, prices of property near stadiums in London and the South East are increasing faster than the rest of the UK, mostly thanks to the improved transport links and abundance of shops, restaurants and bars that are built to accommodate sporting fans.

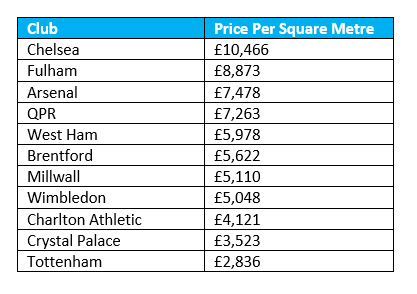

In August 2018 Proportunity, an artificial intelligence forecaster, revealed that properties near Chelsea football club had the highest price per square metre.

The same AI forecaster has also revealed a league ranking for forecasted property price growth for August 2018 to August 2019, which puts West Ham top for a short-term investment.

1. West Ham

2. Fulham

3. Arsenal

4. Chelsea

5. Millwall

6. Tottenham Hotspur

7. Wimbledon

8. Brentford

9. Queens Park Rangers

10. Charlton Athletic

11. Crystal Palace

Looking longer term, estate Agents Savills has forecast a 14.2% rise in national house price growth over the next five years.

If these predictions are correct, in the next four years, this could mean an increase of £72,000 in value for those who purchase an ‘average’ property near the New Den soon, and a £26,270 increase near Bramley Moore, before any major building works.

Furthermore, if the same growth is seen in the next two decades as that revealed in Halifax’s data of 1997 to 2017, investors could expect an average 450% increase in property prices for buildings near Premier League stadiums.

Our MD, Ben Lloyd, commented:

“The statistics are compelling, it’s great to see that as a result of the development of new football grounds its proven to not only stimulate local infrastructure investment, regenerate tired or unused areas of the cities but to create an unprecedented rise in house prices in the immediate area of redevelopment.”

If you’re considering purchasing an investment or development property, whether near a stadium or not, our team of experienced commercial finance brokers can help get you the finance you need. Get in touch today to discuss your needs.