July 12th, 2019. Tom Rowlands

Analysing the Brexit Effect on Construction Mid 2019

Reports in recent months have suggested that the Brexit effect on construction is being felt. Back in April, the Federation of Master Builders (FMB) blamed Brexit for the fall in construction output due to uncertainty. Other reports and data have indicated that the construction industry is in a downfall, but is this downturn affecting smaller developers and lending? If so, how is this occurring?

If you’re concerned about Brexit and the future of construction in the UK, then our impartial development finance advice can help.

What Does The Data Say?

In terms of figures, the future of the construction industry in the UK looks less than healthy. Returning to the statement by the FMB, this was made following a drop of output in March. While this fall was only small, it was significant as it was the first back-to-back fall in the construction industry since 2016.

Immediately, the FMB director of communications Sarah McMonagle stated that “the construction industry is being seriously affected by Brexit uncertainty” imploring that it is time the “[Brexit] deadlock is broken”.

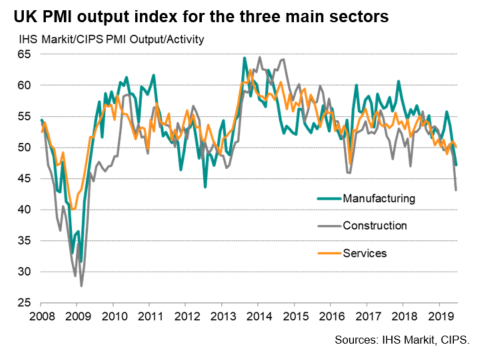

More broadly, recent data has illustrated further downfall in the construction industry. The PMI index for June showed near-stagnation of the UK’s service sector, with construction the worst performer. In fact, according to the index, the construction industry is in its worst state since 2009-2010.

What Does This Mean for Developers?

With largescale construction beginning to slow, the demand for property will likely soon rise, providing ample opportunity for experienced developers to fill a gap where there is less competition. This could involve the refurbishment or extension of existing properties or the construction of smaller scale developments.

Read more: Are Abandoned Properties a Good Opportunity for Developers?

What About Foreign Investment?

Appetite for commercial property in the UK is falling across the board from Europe. With German investors, BrickVest noted that the interest figure fell to 14% down from 19%, with France falling 10%.

Interestingly, these countries are seeing increases in their domestic commercial property. Overall, there’s a shift from Europe underpinned by anxiety over commercial property in the UK which, albeit slowly, could trickle down to small developments.

Is Development Finance Still Available?

As Brexit draws on, it’s going to become more difficult to secure appropriate high street finance. However, where there’s difficulty comes creativity; there are a number of different finance packages and products that are adapting to this new environment, many of which we can access as specialist brokers.

As we discussed in our House Prices 2019: What Will Brexit Do to the Property Market? piece earlier this year, bridging and development exit finance is fluctuating. However, in the year ahead, development exit finance will increase in popularity as it allows borrowers to refinance completed developments at lower interest rates which have little to no reliance on the construction industry.

If you’re looking for property finance or have any questions about how we can help your commercial portfolio in the pre or postBrexit storm, then get in touch with our team. Our brokers are knowledgeable in the industry and can find you competitive deals, no matter what the financial forecast looks like.

Article By Tom Rowlands

July 12th, 2019

Tom joined Pure Property Finance in 2017 after a career as a Client Wealth Manager, where he spent just under 3 years advising on financial and tax planning. Tom specialises in bridging finance and property development funding, having completed deals ranging from a simple £30K property purchase through to £2m+ mixed-use developments.

See more articles by Tom